The aim of this module is to provide a general overview of all the main aspects of Risk Management starting from the definition of the term all the way to emergency preparedness and future predictions. This module will enable participants to appreciate the functional structures, roles and responsibilites required to ensure an effective enterprise wide risk management.

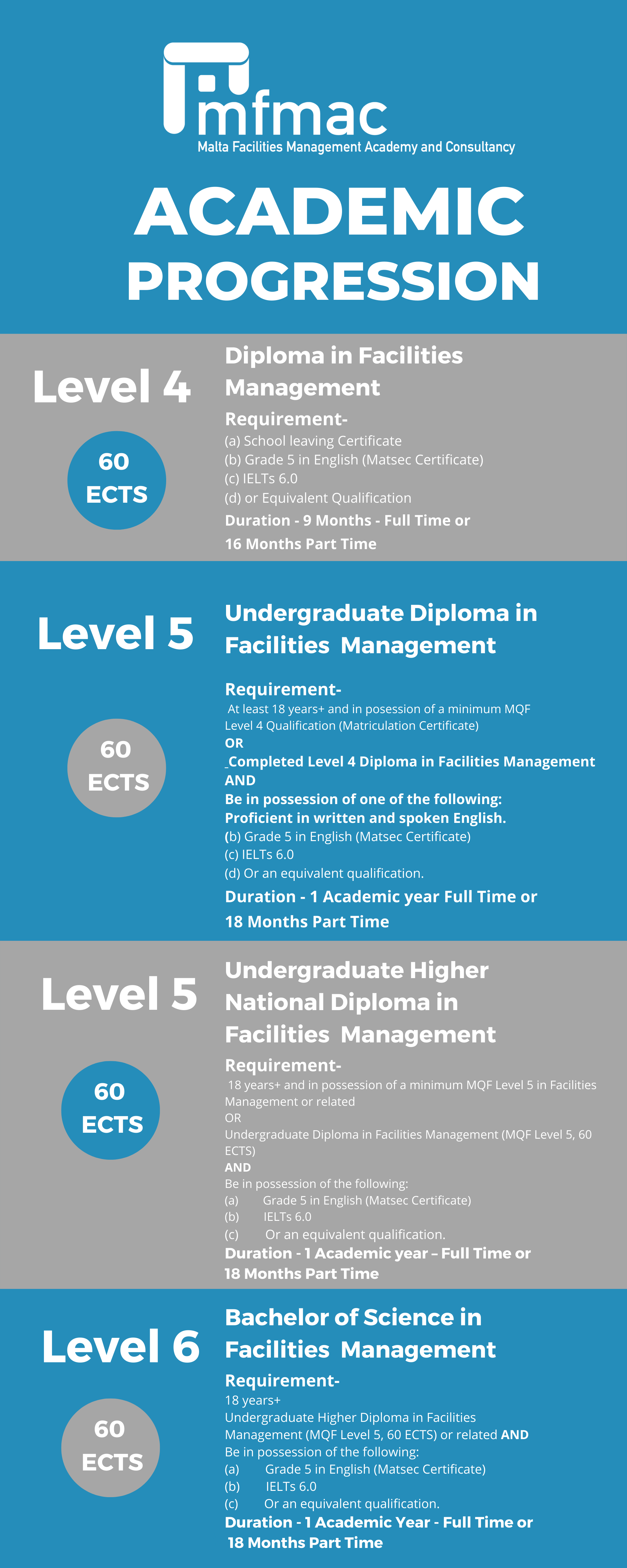

Students should be at least 18 years+ and in possession of a minimum MQF Level 4 Qualification in Facilities Management or related

OR

Level 4 – Diploma in Facilities Management

AND

Be in possession of one of the following:

This course is targeted at:

At the end of the module/unit the learner will have acquired the responsibility and autonomy to:

At the end of the module/unit the learner will have acquired the following skills:

This module shall be taught making use of synchronous teaching methods whereby participants will be engaged in learning at the same time. A highly interactive class, where all participants will be encouraged to engage and participate, share and gain from each other’s knowledge and experience.

Exam, Case Study & Group Presentation

© 2022 All rights reserved